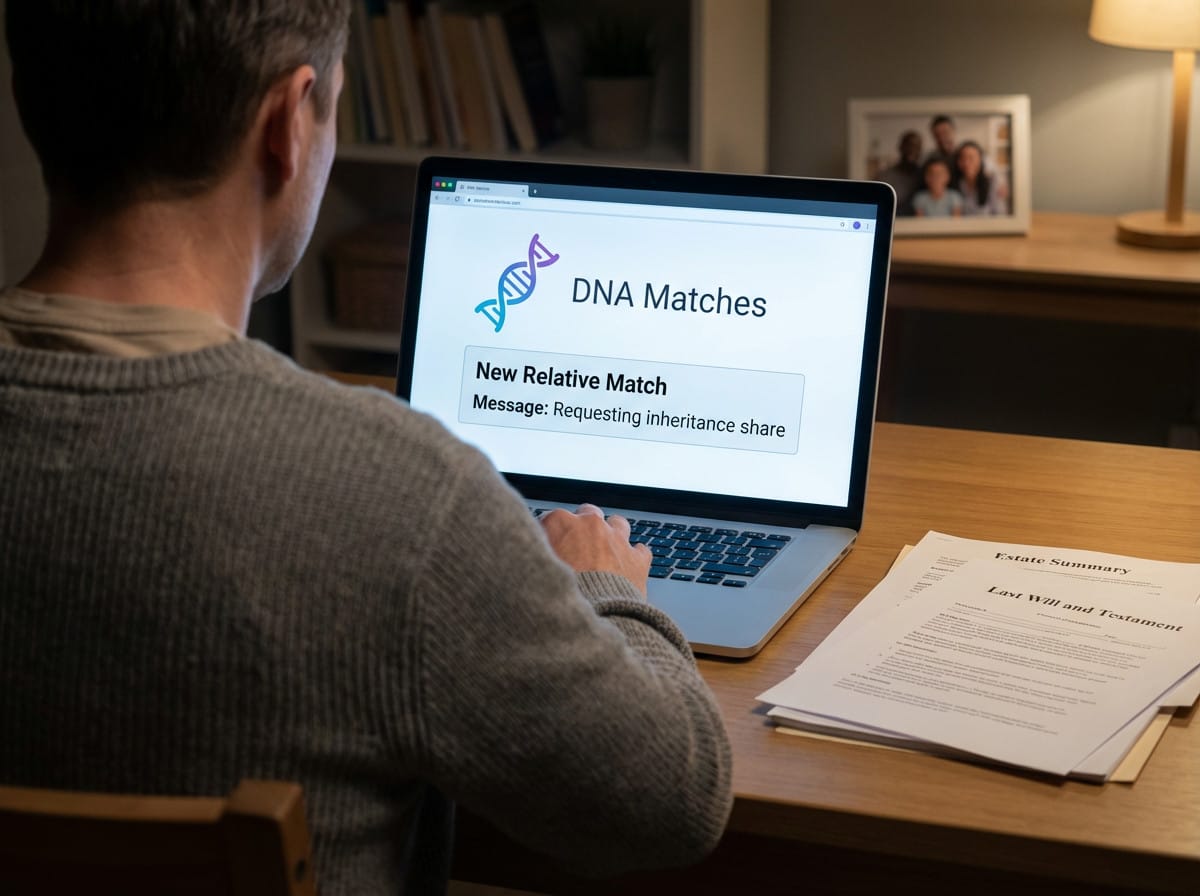

They Found a Match on 23andMe and Wanted Money

The growing popularity of at-home genetic testing kits, often taken out of simple curiosity to learn about ancestry or health risks, is inadvertently creating complex challenges for families and their financial legacies.

We are now seeing a rising trend where individuals who discover they are a surprise half-sibling or child of a deceased person through a DNA match are initiating legal action to claim a portion of a settled estate. This unexpected connection, sometimes decades after an estate was closed, can lead to costly litigation and the possible redistribution of assets in a way the original owner never intended, turning a simple genetic curiosity into a serious legal matter for your heirs.

This emerging risk highlights the critical importance of absolute clarity and precision in your legal documents, an action-oriented step that can protect your family from future disputes. When writing or updating a will, relying on general language such as "my children" or "all descendants" may no longer offer sufficient protection, as DNA technology can easily identify previously unknown relatives who may have a legal basis to claim inheritance. We urge you to consult with your estate attorney to ensure every intended beneficiary is named using their full legal name and, importantly, to consider adding a specific exclusionary clause that clearly states any relative unknown to you at the time of signing is intentionally excluded from the estate.

Staying informed about risks like this is key to maintaining a strong and secure financial plan, ensuring that your final wishes are respected and your legacy is preserved for those you intended to provide for. We encourage you to review the full details of this trend, including specific examples of families who have had estates challenged by a DNA match.

Read the article here.