The Case For Benign Neglect

Benign neglect, bordering on sloth, remains the hallmark of our investment process - Warren Buffet.

Carl Richards, who writes a blog for the New York Times, had an interesting entry last year that I thought bears repeating. Titled "What You Don't Know About Your Portfolio May Help You," Mr. Richards expands on Warren Buffet's statement that "benign neglect, bordering on sloth, remains the hallmark of our investment process."

With 24-hours business cable news channels, and the nightly news sometimes leading with today's Dow Jones Industrial Average rise or plunge, it's easy to get into the mode of "OK, I know what happened to the market today, now what am I going to do about it?" According to Mr. Buffet, perhaps the best thing to "do about it" may be -- nothing!

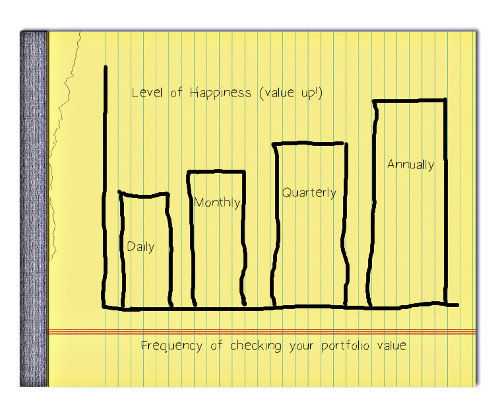

Let's look at the chart at the top of this post. In rough terms, it illustrates your chances of being happy with your portfolio depending on how often you check its value. Using the S&P 500 index (a broader measure of the market than the DJIA), and looking at the period 1950-2012, we find that:

- If you checked daily, it would be positive 52.8% of the time.

- If you checked monthly, it would be positive 63.1% of the time.

- If you checked quarterly, it would be positive 68.7% of the time.

- If you checked annually, it would be positive 77.8% of the time.

Note that your return does not change based upon your frequency of checking. Add to this the fact that, historically, the market has returned about 10% on an annual basis, while investors have achieved a dismal 3%, and that we're more likely to feel the pain of a loss more acutely than the joy of a gain, then checking your portfolio more frequently seems to be a prescription for hitting yourself on the head with a hammer because it feels so good when you stop. The more bad news you hear, the more inclined you are to "do something" with your investments. Oftentimes, the best thing your financial advisor can do is keep you from doing something. Don't be surprised then, if, when you call us up because the market just dropped 100 points, we respond with a resounding "So?"