Roth IRA vs. Roth 401(k)

If you're lucky enough to have access to a Roth 401(k) through your employer, you probably know that there are a couple of differences, to your advantage, that the Roth 401(k) has over an individual Roth IRA.

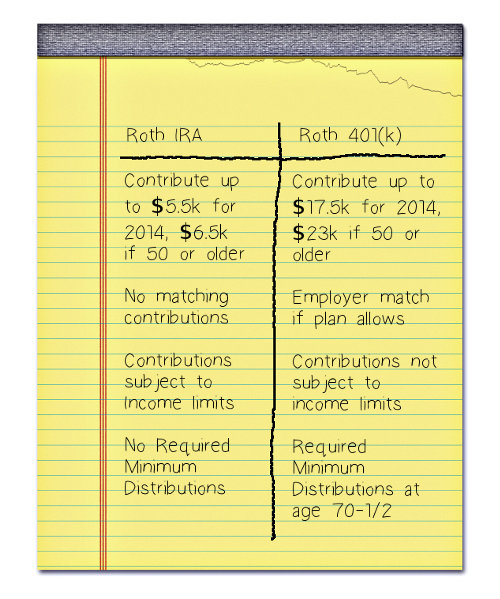

First, the contribution limits are significantly larger -- in 2014, you can contribute up to $17,500 ($23,000 if over 50) per year to your Roth 401(k), while your contributions to a regular Roth IRA are limited to $5,500 ($6,500 if over 50). You cannot contribute to a Roth IRA at all if your income exceeds the IRS limits, while these income limits do not apply to a Roth 401(k).

However, there is one disadvantage to the Roth 401(k) that you should be aware of. Unlike a Roth IRA, a Roth 401(k) is subject to the employer plan rule that Required Minimum Distributions (RMDs) must be taken starting at age 70-1/2. If you were counting on not having to take an RMD from this asset, then you will need to roll your Roth 401(k) assets into a Roth IRA before the year in which you turn 70-1/2.

Like a 401(k) plan, you do not have to take an RMD if you are still employed and contributing to the Roth 401(k) after age 70-1/2. Once you leave that employment, the RMD rules will kick in. If this sounds confusing, be sure to contact one of our financial advisors.