Required Minimum Distributions

These are withdrawals from IRA accounts required by the tax code once a person reaches the age of 70-1/2 and every year thereafter. The IRS imposes a 10% penalty if you get it wrong.

If you read USA Today, you might have read an article a while ago about Required Minimum Distributions ("Don't let IRS gobble your IRA with tax penalties," December 26, 2013). These are withdrawals from IRA accounts required by the tax code once a person reaches the age of 70-1/2, and every year thereafter. (NOTE: The SECURE Act of 2019 changed the age to 72) Unfortunately, if you did read the article, you were given some bad information (it has since been corrected in the online version of the article). The author first states that the initial withdrawal rate starts at 5%, when in fact it's closer to 4% -- not a big mistake, but he then uses the wrong IRS table to calculate his example RMD, overstating it by over $10,000 from a $500,000 IRA account.

Besides being another example of bad information in the media, the article also serves to emphasize the fact that you really need to consult with your financial advisor (hint: Marc, Matt, or Paul) when you find yourself in the RMD phase of your investments. There is so much more to consider when complying with the IRS RMD regulations that are not even mentioned in the article:

-

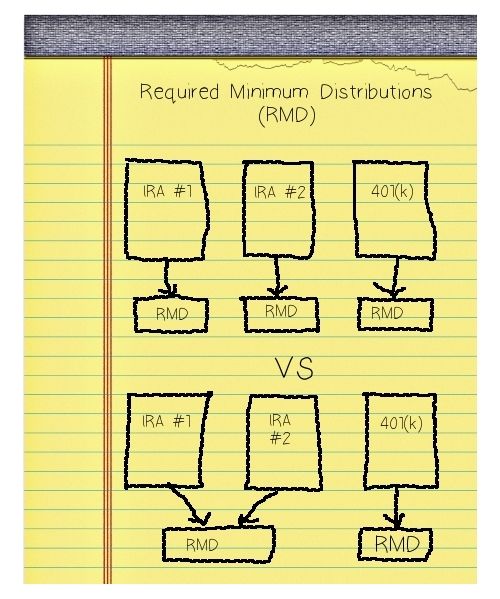

Instead of withdrawing your RMD out of each IRA account, you can calculate your total RMD for all IRA accounts and make the withdrawal from only one account. Depending on the type of account (annuity, regular IRA or 401(k)) or the investments in the account, this might be a better strategy for your particular situation. Note, however, that the total calculation must be for the SAME TYPE of IRA account. You cannot withdraw your RMD for your 401(k) from an IRA, or vice versa (see the diagram above). Also, you cannot combine 401(k) account RMDs, nor can you combine a regular IRA with an inherited IRA, although, if you have multiple inherited IRAs FROM THE SAME PERSON, they can be combined.

-

In some cases, the IRA custodian will calculate the RMD for your account value and send you a check or automatic deposit for that amount. However, if you're implementing a withdrawal-from-one-account strategy, you will need to contact that custodian to block that automatic withdrawal sometime before it occurs (usually in early December).

For more information on the rules regarding RMDs, you can read this article on our website, or call one of our financial advisors.